reverse tax calculator quebec

If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237. You must use the 9975 rate to calculate the QST if your cash register calculates the GST and QST in two steps that is if it calculates 5 GST on the sale price then also calculates the QST on the sale price.

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Current 2022 GST rate in Canada is 5 and PSTRST rate in Manitoba is 7.

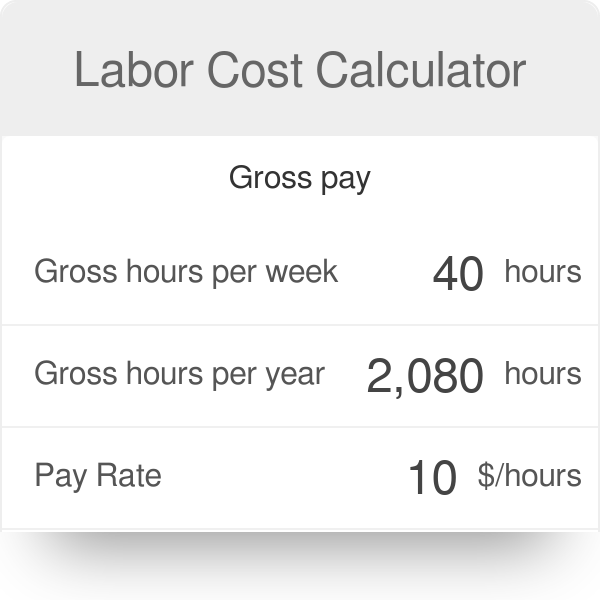

. Before Tax Amount 000. Over 117623 up to 159483. That means that your net pay will be 36763 per year or 3064 per month.

Reverse GST Calculator. Over 96866 up to 117623. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

This will give you the items pre-tax cost. This marginal tax rate means that your immediate additional income will be taxed at this rate. The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013.

Now you divide the items post-tax price by the decimal value youve just acquired. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount without Tax Amount with Taxes - Tax Amount. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

That means that your net pay will be 40568 per year or 3381 per month. HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2021 for. Your average tax rate is 293 and your marginal tax rate is 438.

Price before Tax Total Price with Tax - Sales Tax. Quebec tax bracket Quebec tax rate. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Over 42184 up to 84369. If youre looking for a reverse GST-only. The reverse sales tax calculator exactly as you see it above is 100 free for you to use.

Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon GST Tax Rate. Amount without sales tax GST rate GST amount. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

If youre selling an item and want to receive 000 after taxes youll need to sell for 000. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. Your average tax rate is 220 and your marginal tax rate is 353.

Reverse Sales Tax Formula. Provinces and Territories with GST. Over 84369 up to 96866.

Montant sans taxes Taux TPS Montant de la TPS. Minus Tax Amount 000. GSTQST Calculator Before Tax Amount.

Over 159483 up to 222420. Reverse Sales Tax Calculations. Amount without sales tax QST rate QST amount.

The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013. Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to. Here is how the total is calculated before sales tax.

Lets calculate this value. Sales Tax Rate Sales Tax Percent 100. Voici la façon dont est calculé le montant avant taxe.

This rate may be rounded off to 997 only if your cash register cannot process three-decimal numbers. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Quebec Canada. Current 2022 GST rate in Canada is 5.

Calculates the canada reverse sales taxes HST GST and PST. Montant sans taxes Taux TVQ Montant de la TVQ. Click the Customize button above to learn more.

Use our calculator to determine your tax or Reverse Quebecs cur Welcome to Calcul Taxes. Divide the price of the item post-tax by the decimal value. Reverse GSTQST Calculator After Tax Amount.

Montant avec taxes Montant TPS et TVQ combiné 114975 Montant sans taxes. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975. 2675 107 25.

Get the reverse sales tax amount from the total calculation including taxes how to calculate reverse sales tax in 2022. Online calculator calculates Reverse Québec sales taxes - GST and QST 2020. Plus Tax Amount 000.

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

3 Things We Wish We Had Done When We Had More Money Debt Management Mortgage Calculator Debt Management Plan

Canada Sales Tax Calculator By Tardent Apps Inc

Setting Up Taxes In Woocommerce Woocommerce

Quebec Tax Calculator Gst Qst Apps On Google Play

Quebec Sales Tax Calculator On The App Store

How To Calculate Sales Tax In Excel Tutorial Youtube

Canada Sales Tax Gst Hst Calculator Wowa Ca

Quebec Tax Calculator Gst Qst Apps On Google Play

Reverse Sales Tax Calculator Gst And Qst Calendrier Live

![]()

Quebec Sales Tax Calculator On The App Store

New Google User Interface Updates Refine Layers Mini Carousels Shopping Toggle Mortgage Calculator More Online Mortgage Mortgage Payment Calculator Mortgage Calculator

2021 2022 Income Tax Calculator Canada Wowa Ca

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca